Here's EXACTLY how I cashed a 287% profit on my first Kalshi trade by leveraging our PGA betting data

As the sports betting landscape evolves, savvy bettors are continuously looking for value beyond traditional online sportsbooks. Enter Prediction Markets. While technically not "betting" in the legal sense, platforms like Kalshi are becoming an essential tool for those of us hunting for an edge.

At Dimers, I spend my time analyzing our data to beat the books. Recently, I began an experiment to see if our Dimers Pro models—typically used for traditional sportsbooks—could also effectively identify inefficiencies in these emerging markets.

The hypothesis was simple: if a prediction market price deviates significantly from our projected probability, there is value to be extracted. To test this, I applied a fundamental "+EV" (positive expected value) strategy to the American Express PGA tournament. The result was a 287% return on investment.

Here’s exactly how I found the edge and executed the trade.

1. The Setup: Finding a Soft Market

I signed up for Kalshi with the promo code "DIMERS" to unlock the "Trade $10, Get $10" offer. (But if I'd already had a Kalshi account, the strategy still would have been viable.)

Seeking "soft" markets, I focused on futures, which often hold the most inefficiencies. With the American Express PGA tournament starting in a few hours, I started my search there.

If you use a "DIMERS" promo link to sign up at Kalshi, this the screen you'll land on.

If you use a "DIMERS" promo link to sign up at Kalshi, this the screen you'll land on.

2. Identifying the Edge (The Math)

Using Dimers Pro data, I treated Kalshi prices as implied odds to spot discrepancies.

Market Price: Scottie Scheffler traded at $0.26, implying a 26% win probability.

The Data: Our Dimers Pro model projected a 34.5% win chance.

The Calculation

Subtracting the market's implied probability (26%) from our projection (34.5%) revealed an 8.5% edge. This wasn't a gut feeling; it was a pure math play where the market significantly underpriced Scheffler, creating a textbook +EV opportunity.

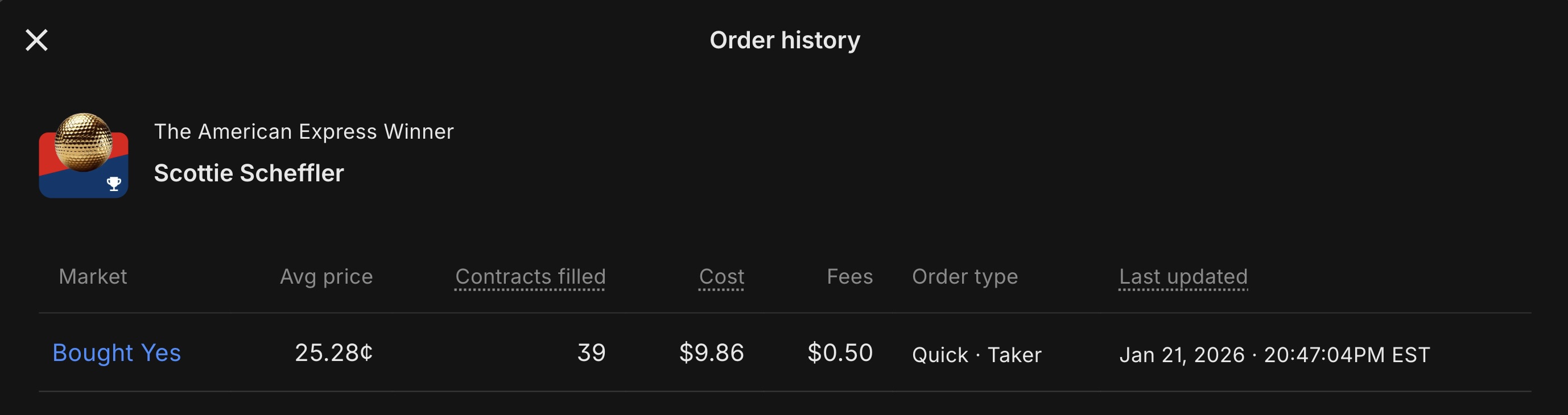

3. Executing the Trade

I aimed to buy $10 worth of contracts for the bonus, but Kalshi filled the order at a better market price than my limit.

Total Cost: $9.86 (39 contracts)

Average Price: 25.28¢

I secured 39 contracts at an average price of $0.25, significantly better than the initial limit price.

I secured 39 contracts at an average price of $0.25, significantly better than the initial limit price.

Insider Note: Since the trade filled at $9.86, I needed to trade another $0.14 later to unlock the bonus. Always check your fill price to ensure you hit the promo requirement!

4. Managing the Position

A key advantage of prediction markets is real-time pricing. I watched the contract value fluctuate with the tournament action:

Round 1: Scheffler trailed by 1 stroke, but the price rose to $0.34, then $0.40.

Round 3: Tied for the lead, the price ticked to $0.44.

Round 4: With a commanding 3-stroke lead, the price surged to $0.98.

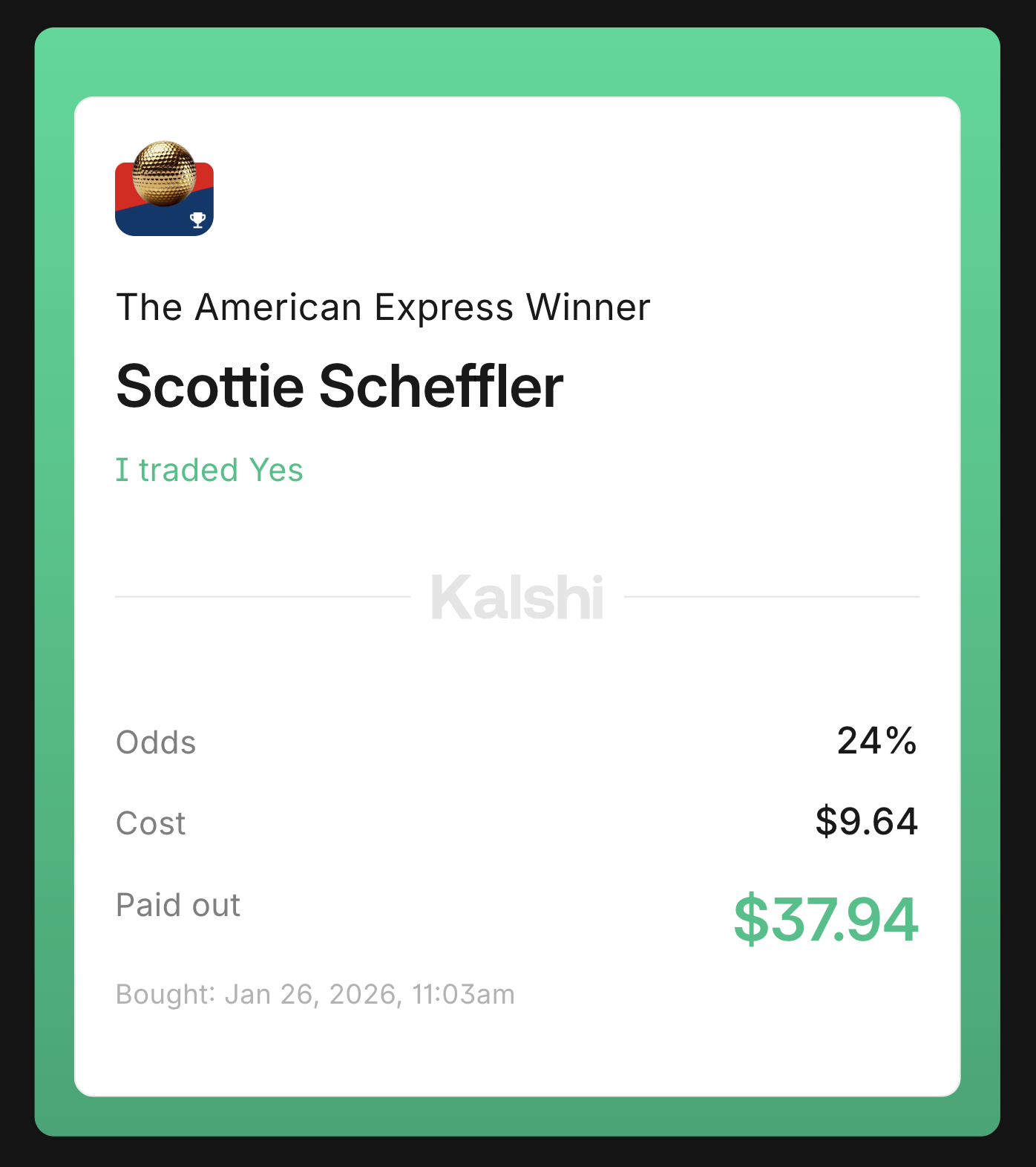

5. The Exit Strategy

With Scheffler leading by 3 strokes late in the final round, I faced a choice: hold for the $1.00 payout or sell immediately. I chose to close (slightly) early.

Sell Price: ~97.85¢

Net Profit: $28.30 (287% ROI)

Closing the position early at ~$0.98 locked in a 287% return, avoiding the sweat of the final four holes.

Closing the position early at ~$0.98 locked in a 287% return, avoiding the sweat of the final four holes.

Retrospective: Analyzing the Results

While this result looks great on a spreadsheet, it is important to analyze the process objectively to understand how to replicate this success long-term.

Understanding Variance

According to Dimers Pro, Scheffler had a 34.5% chance of winning. This means that the specific outcome I bet on was actually projected not to happen 65.5% of the time. While I identified a mathematically profitable spot, the result still relied on variance breaking my way.

The Risk of Holding

In retrospect, holding the position until the final holes was risky.

Had I held until the very end to cash out at $1.00, my payout would have only increased by approximately $0.84.

Risking a potential collapse on the final few holes for less than a dollar of extra profit is generally not an optimal strategy.

Opportunities for Hedging

A more sophisticated approach for future trades would be to lock in profits earlier.

Early Profit Taking: I could have exited after Round 1 for an approx. 31% ROI, or after Round 3 for a 69% ROI. These would have been lower-stress wins.

Hedging: I could have sold some contracts when the price jumped to cover my initial $9.86 investment, effectively "freerolling" the rest of the tournament.

What Did We Learn?

This trade serves as a successful proof of concept. The strategy was straightforward: find the delta between implied probability and actual probability.

I got the result I wanted this time, but the 8.5% edge I identified was the real win. That is the takeaway. By applying rigorous data analysis to these new markets, we can uncover value that the general public misses. The edge is usually there; you just have to know where to look.